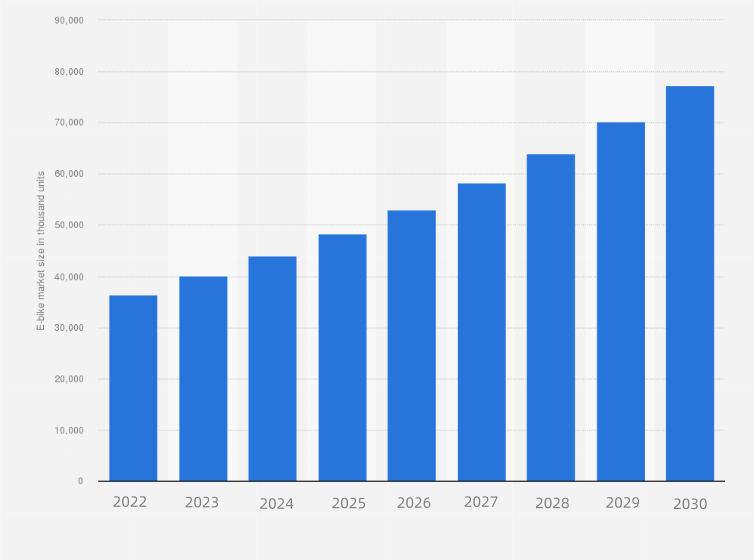

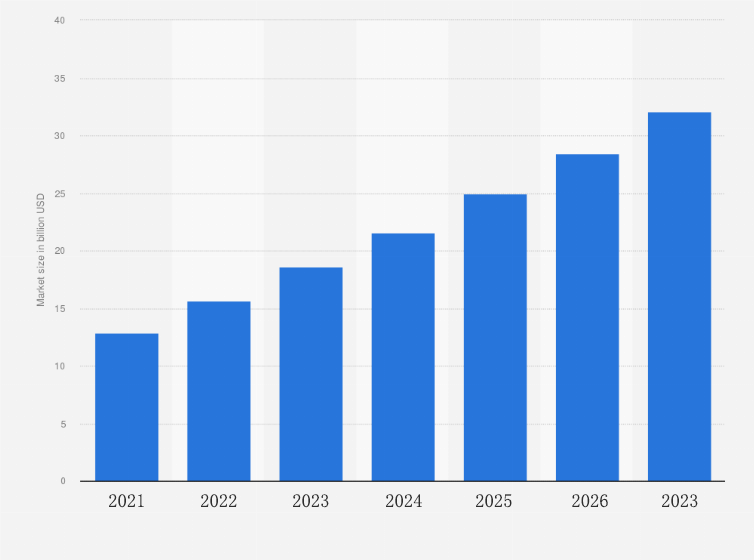

With roads quieting down during the onset of the COVID-19 pandemic in 2020 coupled with people looking for ways to travel and exercise in a socially distanced manner, cycling and investments in cycling infrastructure rose substantially in many European countries during that year. Part of this cycling boom was an increase in demand for e-bikes. For instance, e-bike sales in Italy grew by 44% between 2019 and 2020 and continued to rise in 2021. The overall value of the European e-bike market is also projected to grow between 13 and 16 percent year-on-year between 2022 and 2027. The Netherlands, the country with the highest cycling modal share in Europe, is expected to experience particularly strong growth in the e-bike market, with sales doubling between 2022 and 2027. Additionally, Germany sold 2 million e-bikes in 2021, representing the largest market for e-bike sales in Europe that year.

What is an e-bike?

While e-bikes are becoming increasingly common on European roads, there remains some confusion about their definition as well as their legal status on the road.

Electric bikes can be broadly divided into two categories: basic pedelecs, or electronically power-assisted cycles (EPACs), and speed pedelecs with significantly more power. Though all e-bikes have a motor that supports the rider’s propulsion and pedals that function as on a regular bike, the amount of power capability can vary greatly. The first category – basic pedelecs – are legally classed as bicycles in most European countries. On these bikes, the rider is assisted by the motor while pedaling, but the motor stops providing pedal assistance when the rider ceases to pedal or reaches 25 km/h or 15.5mph. The second category – speed pedelecs – consists of more powerful e-bikes, allowing riders to reach much higher speeds; some can even provide power when the rider stops pedaling. Due to these features, speed pedelecs are legally classified as a type of moped or motorcycle and are, therefore, often more strictly regulated.

EPACs are the primary driver in the electric bicycle boom. In the Netherlands, where e-bikes now make up more than half of the sales value of new bicycles, EPACs vastly outnumber speed pedelecs. In 2021, EPACs outsold speed pedelecs by about 120:1. Due to their dominance in the market, the term e-bike or electric bike is often used colloquially to refer exclusively to EPACs.

Who uses e-bikes?

While there is a perception in some parts of Europe that e-bikes are for older people, who may find a regular bike too taxing and welcome the additional support of the electric motor, the age group most likely to consider using an e-bike is 25 to 34-year-olds. However, in some countries, the likelihood of using an e-bike does lean more toward older age groups. In Poland, a country with many regular cyclists, interest in e-bikes is highest among people aged 35 to 54.

Regarding the styles of bikes considered for purchase by Europeans, city e-bikes are the most popular choice. City bikes are primarily designed for comfort, convenience, and utility on short to medium-length trips in urban environments. Next to more traditional bike styles, twelve to thirteen percent of younger people between 18 and 34 years old also indicate an interest in electric cargo bikes. These bikes usually have a cargo box or platform, which allows riders to carry larger and heavier loads and are particularly useful for young families.

However, relatively high prices of e-bikes can still pose a hindrance to their purchase and use, with 41% of respondents to a YouGov survey indicating that a subsidy might be an incentive to buy or hire an e-bike. Yet, respondents also recognized the overall lower running cost of an e-bike compared to a car. Nearly half of respondents saw the cost of living, including fuel prices, as a reason to use an electric bike.

With sales continuing to grow, electric bikes are now solidly established as part of the European bicycle market and are likely to impact the future cycling habits of Europeans substantially.

(Published by Statista Research Department, Aug 8, 2023)

Forecast the e-bike market volume in the EU market

According to the data from statista.com to forecast the e-bike market volume in the EU market, there are stable and good development trends for e-bike manufacturers and sellers. However, foreign brands that import e-bikes to European countries have to comply with local rules and regulations. Here are some professional compliance tips for those e-bike brands. Contact us for more details. Click more regulations in another article.

Business compliance

Electronics Digital Passport

VAT Compliance

EPR Compliance

Recycling Compliance

Green Compliance

….

In the end, here is a recent discount from Allegro, the largest E-commerce platform in East-European.

If sellers register for Polish VAT through the exclusive link (https://product-ident.com/allegro?utm_source=qr+code&utm_medium=register&utm_campaign=exclusive+discount&utm_id=Polish+VAT) and join the Allegro One Fulfillment Service campaign, the registration and first-year declaration fees will be borne by Allegro, and the event will end on December 31, 2023.

A Golden Opportunity: Europe’s Outdoor Gear Flourishes in Fall

The Battery Digital Passport: Charting the EU’s Path to Sustainable Battery Production